It’s almost time to plant the broccoli, brussle sprouts, and kale! We’ve gotten a few harvests from the bush beans (and I planted more seeds a few weeks ago), and the wall of pole beans is covered in flowers. Anya and I have been snacking on pea leaf microgreens (and macrogreens!) — and rabbits apparently love pea plants above any other plant. The little bed of microgreens seems to have saved the rest of my garden from nibbles. The corn is almost as tall as I am, and the cucumber plants are covering the A-frame. Tiny peppers are starting to form on the plans

And I’ve got dozens of green tomatoes

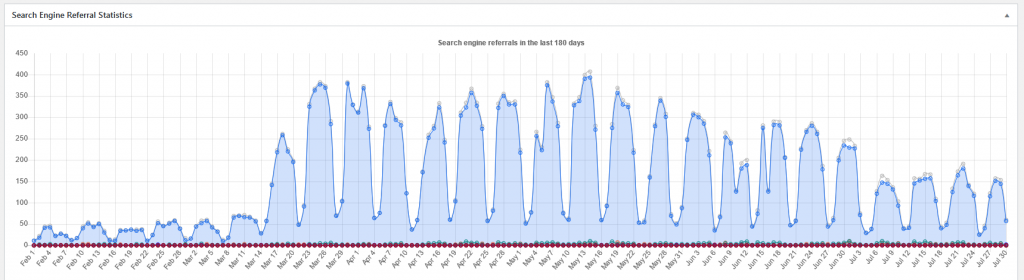

It looks like moving the garden to a sunnier spot has been a huge improvement in production.

Next year,I want to adjust the planting schedule:

March: Start the peppers, tomatoes, watermelon, pumpkins, squash, and cantaloupe indoors. Plant snow peas outdoors.

Late April: Start the corn indoors.

Mid/late May: Plant the plants that have been growing since March. Sprinkle carrot seeds around the tomato plants — that worked quite well as I’ve never had carrots grow before. Plant the bush and pole beans outdoors.

June: Plant the corn outside. Start the broccoli, kale, cabbage, brussel sprouts, and cauliflower indoors.

July: Plant second round of bush beans outdoors.

August: Plant broccoli, kale, cabbage, brussel sprouts, and cauliflower