Shelf mushrooms growing on a tree stump in the woods

Category: Miscellaneous

On art … 2

What you know

I don’t get why school boards (and businesses, for that matter) are so stuck on attempting to replicate what we had two years ago. It’s like some form of denial — it’s going away soon, no reason to rethink things we’re doing.

I cannot help but think of veggie burgers. Attempts to be “beef like” are generally awful. Attempts to make a flavorful, filling, crunchy sandwich filling that bears little resemblance to a beef burger? Lots of delicious options. I think that was what I liked so much about SNL’s at home episode … it wasn’t *trying* to be like an in-studio production. It was a new thing that was entertaining in its own way. I don’t know what the school version of my spicy garbanzo sandwich or SLN@Home would be … but, having seen The Reopening Plan, I know that my local school board spent the last four or five months trying to figure out how to achieve the most school-like thing possible regardless of the long-term feasibility of the solution (and they’ve got a slide detailing the “swiss cheese” approach to risk mitigation … something gets through each layer but risk is mitigated by the aggregation of layers. Nothing says safety like swiss cheese!).

Creating continuity between in-class and at-home learning so individuals with resources (time, money, internet access, computers for kids to use) could participate at home and reduce the number of people on the bus, in the classroom, at lunch, etc does not appear to have been an avenue of exploration. This would allow individuals in quarantine to continue their education uninterrupted, too. The district’s plan right now is … they’ve got no idea what to do when a class full of students is asked to stay home for two weeks.

Reopening Plans

Yeah, this is going to be a nightmare. I have an awesomely well behaved kid. One with a lot of deference to non-parental authority. She’s also decidedly not an automaton and does her own thing. Which is developmentally great, but not so great in a carpark. She would totally wear a mask all day in school, even if it’s 90 degrees in the classroom (which happens, no AC in this old building). She will walk in a spaced-out line and play by herself at recess if that’s what the teacher says to do. She’ll also rub at her eyes, do a crap job of washing her hands before eating (and there’s no way the teacher is ensuring everyone is properly clean before lunch and snack), take her mask off while walking up the driveway and chew on her finger because she’s growing a new molar. There are kids who had three warnings in a day *before* all of these risk mitigation rules went in place.

How much time is a teacher going to spend teaching when they’re also reminding kids to keep their masks on, not share that crayon, no you cannot move your chair and sit closer to Timmy. Even if online education isn’t as effective as in-person education was two years ago … I think it is going to be far more effective than trying to teach in between warning kids about breaking rules.

And that’s just elementary school kids. From what I hear from friends with older kids, the district has been completely unable to address physical assault (which they like to call bullying, but someone who walked up to me on the street and punched me in the face would totally be getting changed with assault). How in the world are they going to address someone who thinks its a gas to rip off someone else’s mask and sneeze in their face?

At that, how are they going to address someone who gets sent into school with a fever? From a strange conversation I had with the nurse’s office when my daughter had bloodshot eyes from allergies, I kind of gather that the nurse cannot make medical diagnoses and could not *make* me come pick her up. Five cycles of “I’m sure you want to get her tested for pinkeye” / “she’s got allergies” and I gave up and got my kid. I guess they can use the gymnasium as a room for possibly infected kids sitting 20′ apart.

Web Stats

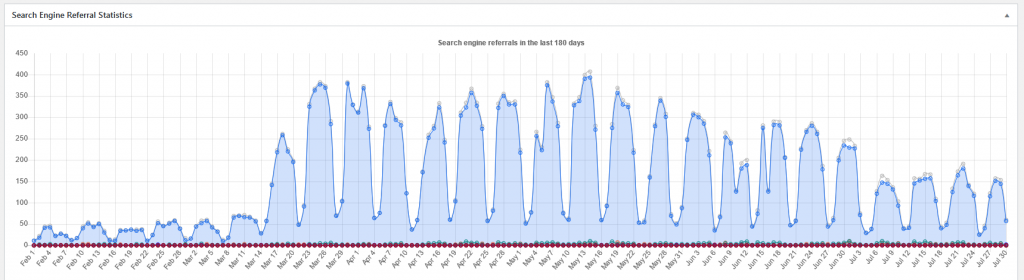

Since my website has a lot of information about Microsoft Teams, I can see when a lot of new Teams users came online during the lockdown. Now that people are returning to offices (and, I expect, are more familiar with the platform), I’m starting to see fewer search engine referrals. But I’m still 3-4x the numbers I’d seen pre-lockdown.

The Proliferation of Misinformation

A friend mentioned that Madonna has jumped on the demon-sperm-doctor’s ‘a cure exists’ train. To which someone replied “who cares?” … which is a reasonable gut reaction. Some celebrity, or has-been celebrity, wants to walk around telling everyone they need to get Airpods? I don’t care.

I don’t care that one individual believes, well, any crackpot idea or conspiracy theory either. There was a guy in downtown Philly who walked around with a sign declaring that the alien invasion was nigh and we should save ourselves by … I don’t even remember what he thought would appease our future alien overlords. People generally ignored him or felt sorry for him. Sometimes gave him a hairy eyeball. And we all carried on.

When the crazy idea is picked up by more individuals? Nonsense is less objectionable when a lot of people believe it (i.e. there are people who read this doctor’s statements from the fifth source & think maybe it’s true).

When those who hold sway over a lot of other people start promoting disinformation? Some percentage of Trump’s 84.3 million followers, and some percentage of Madonna’s 2.6 million followers, take this seriously. They use the ‘information’ to justify mask refusal, heading out to parties, etc. Unless you’re completely off the grid, you’ll be sharing space with them at some point. That’s why I care.

Grown Up Temper Tantrums

Death Panels

Texas is going to start sending the least likely to survive home to free up healthcare resources. A few months back, Italy had been floating some metrics for determining who got sent home and who rcv’d treatment. Had a few friends freaked out over the inhumanity of it, but … there’s a limited resource exceeded by need (and a metric may make it easier for healthcare workers charged with delivering awful news to families). To act like the choice is between this awful scenario and something awesome — like we could have this most-apt-to-survive-gets-treatment rule or everyone would immediately be treated (successfully, of course) for whatever ailment — is living in a fantasy world.

Those aren’t the choices available. What we’ve got without “least likely to survive get no treatment” seems to be either first-come-first-serve or highest-bidder. Neither of those are great algorithms for determining who is saved. A “death panel” sounds inhumane (and it’s obviously branding from an opposition group), but some outcome prediction to determine who gets treated … well, I guess it sucks for those with unlimited cash to ensure they’re always going to be the high bidder because they’ve now in the same boat as everyone else. But it’s about as close to an equitable solution as you can get in an awful situation.

One of my biggest problems with politics is the short-attention-span theatrics of it all. Both death panels and now — yeah, someone can come up with a terrifying phrase to make a solution sound unthinkable. But talk about the options and the rational for the approach for an hour and it’s a different picture.

I wish progressives would get better at branding and marketing — yeah, we’ve got death panels. But you’ve got the medical treatment auctioneer. This vial of insulin goes to the highest bidder — and Anne Rice wins this round. Sorry, all you penniless rubes. If you’re not in a coma in two hours, we’ll have another auction.

Hopefully people will be a little more understanding of treatment allocation based on predicted outcomes next time we talk about universal healthcare.

Influenza Data

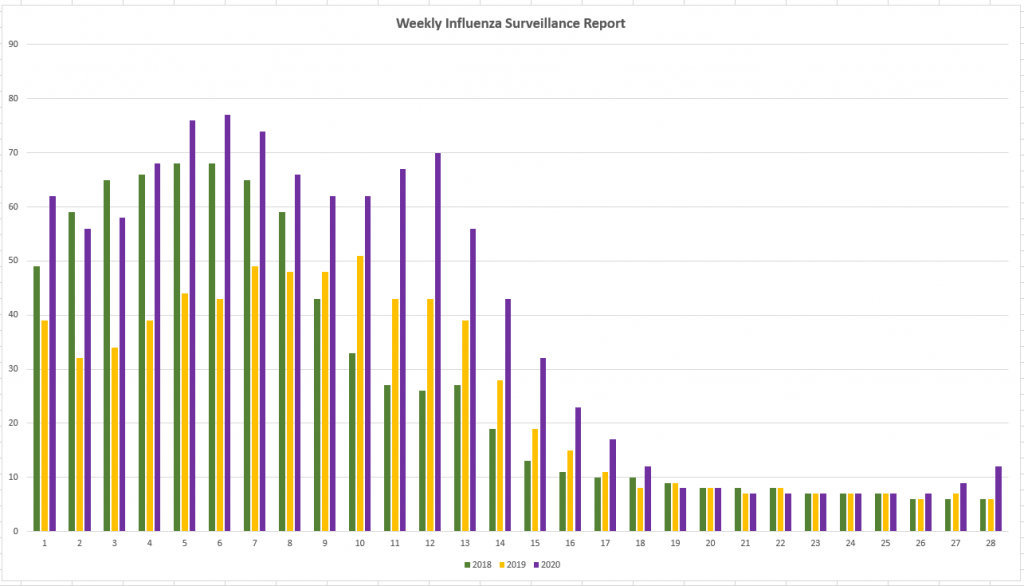

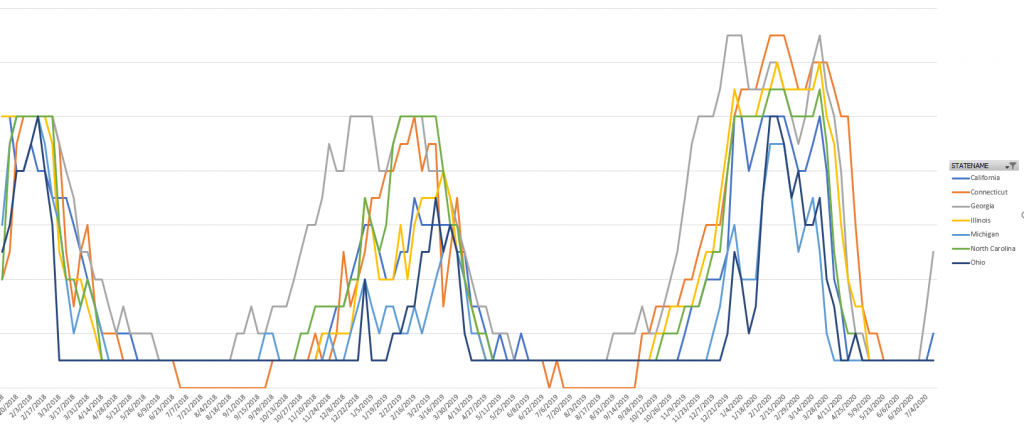

Scott hypothesized that 2020 should have a fairly low rate of illness apart from SARS-CoV-2. The preventative measures taken to limit the spread of this virus should also have reduced the number of people with colds, flu, etc. There’s no way to tell for mild illnesses, but I knew the CDC tracked flu and pneumonia cases … you can link the CDC’s CSV data sources into Excel, create a Pivot table to get rows of week numbers or months & columns of year-by-year case counts, then create a chart that compares case counts year-to-year. Unfortunately, they have a new file name each week. You’ve got to find the latest URL from https://www.cdc.gov/flu/weekly/index.htm

I was surprised to see 2020 significantly higher than the previous two years through the end of April and bumping back up again between weeks 26 and 27 (late June / early July)

Broken out by state and filtered to a few states to make the chart readable, I see the same trend. 2020 is generally higher than 2019 or 2018.

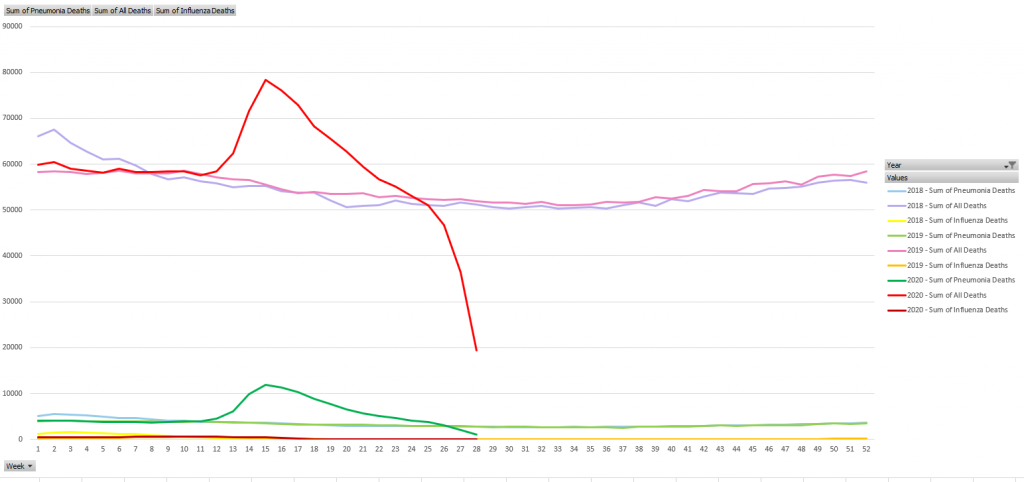

The significant increase in pneumonia deaths this year? That’s probably not people who actually had pneumonia completely unrelated to SARS-CoV-2. The influenza/pneumonia data set includes an “All Deaths” column — which depicts the excess deaths for 2020 (I assume the past month or so of data is not yet finalized, as thee numbers fall off sharply in the final weeks of the data set).

Medina County Court of Common Pleas – iJEMS Wildcard Search

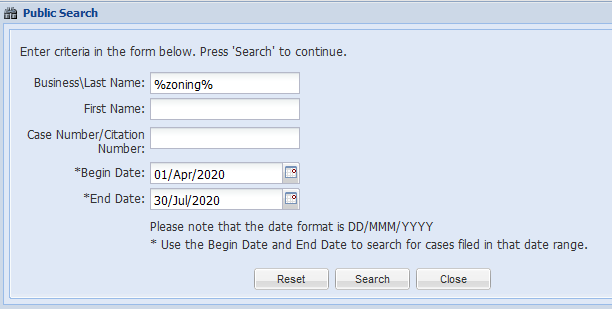

You can perform wildcard searches in iJEMS — to find all of the cases in the Medina County Court of Common Pleas that include zoning in the last name/business field, use the following search: