Roy Moore was quoted in the LA Times saying “I think it was great at the time when families were united — even though we had slavery — they cared for one another…. Our families were strong, our country had a direction.”. This willfully ignores families that couldn’t stay together because their children were stolen from them and sold. *Our* families were strong, and who cares about anyone else? It’s the same implication I’d read into Trump’s ‘great again’ slogan. Well, it was great for rich old white dudes, and since I’m a rich old white dude … that’s my definition of great, and screw everyone else.

If people are going to be blatant about their racism, I’d love some honesty to go with their chutzpah. Political and social power are zero-sum. In game theory, zero-sum means that one person’s gain is your loss. And you can only gain by someone else losing. If the game starts with a stack of one hundred one dollar bills, no one can win more than 100$. Divide the money equally and each person gets 50$. Play the game — the only way for you to get 60$ is for your opponent to lose ten bucks. That’s a concrete example — new dollar bills aren’t going to magically appear. But abstract concepts can be zero-sum as well. Any individual only has so much influence, and their vote is only a percentage of all voters. The larger the population of “people who can make decisions and influence society” or “people who can vote” gets, the smaller any individual’s power becomes.

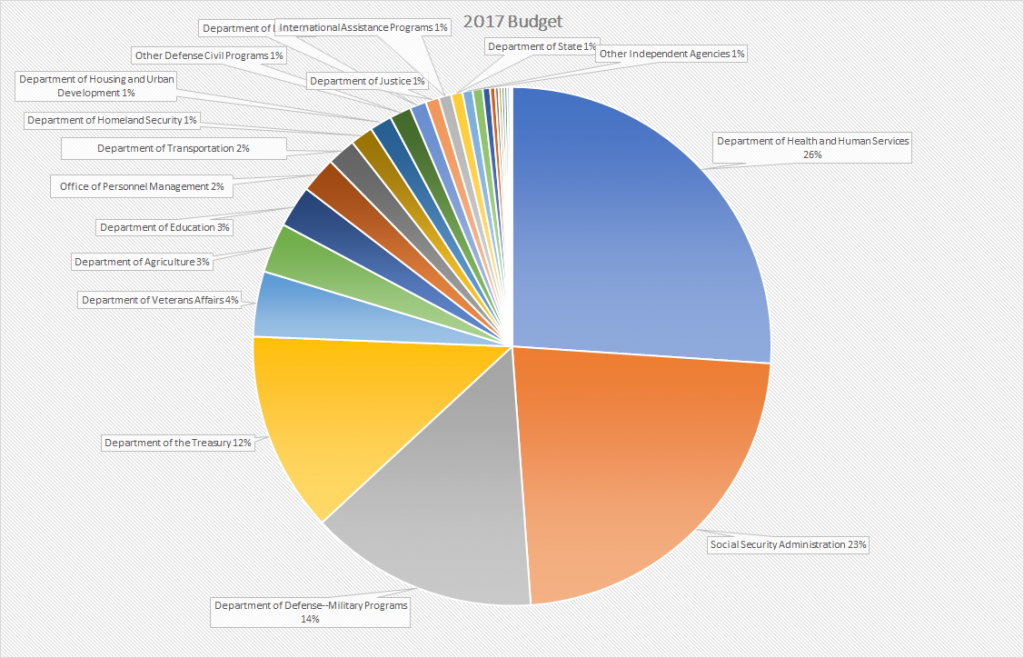

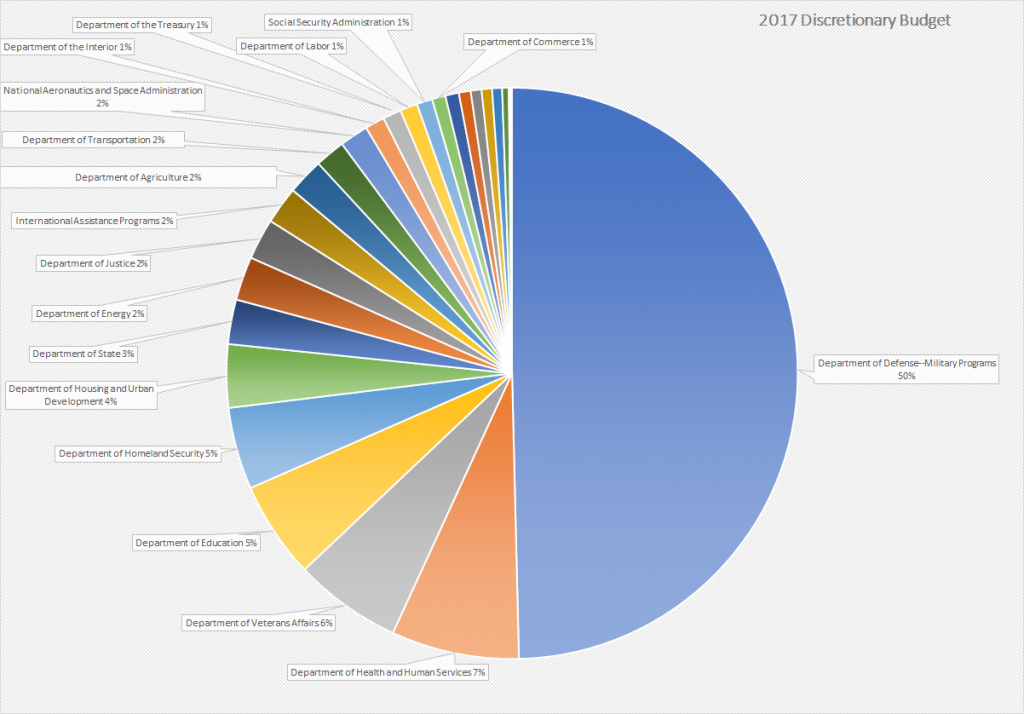

The US population is 326 million plus people (or so says the Census Bureau’s population clock). In 2010, 24% were under 18 – which makes the population at or above the age of majority just over 248 million. That means one person is 0.00000040% of the total adult population. Limit decision makers to white men (31% of the population) and each person’s power (for those who retain power) is tripled. Home ownership rates for whites is like 71.9%, which would mean each person’s power (for those who retain power) is tripled.

Similar story for voting. There were just shy 129 million people who voted in 2016. A Rutgers breakdown of gender/ethicity of reported voters has 47.8 million white men voting. Using the 71.9% home ownership rate, an individual white man’s vote would have a 2.7x increase in impact if only white land owning men could vote.

Some old white land owning dudes think the early 1800’s were great because men in their position weren’t forced to share power with women, non-white people, or poorer white dudes. Some old white land owning dudes think giving up some of *their* power so women/non-white people/poorer people get a say in government and American society was OK because women/non-white people/poorer people deserve some control over the society and political system in which they live. Hell, some rich old white dudes probably think ceding some of their power is OK because they are vastly outnumbered by women/non-white people/poorer people and just didn’t see staying in power as a likely outcome either way, and sharing power was better than all of the women/non-white people/poorer people banding together and deeming rich old white dudes to be non-citizens.